If you’re still tracking client information in Excel, sending reminder emails manually, or digging through your inbox to find that one document from last tax season, you’re not alone. But here’s the thing: CRM software designed specifically for accounting professionals has quietly revolutionized how firms manage their practices over the past few years. These aren’t your typical sales-focused CRMs, they’re built from the ground up for the unique needs of CPAs, tax professionals, and bookkeepers.

Do more with your firm

What used to be clunky, one-size-fits-all solutions have evolved into sophisticated platforms that actually understand how accounting firms work.

The best accounting CRMs now seamlessly blend client relationship management with document storage, workflow automation, and secure portals, all while maintaining the compliance and security standards our industry demands. Whether you’re a solo practitioner or managing a growing firm, the right CRM can transform how you interact with clients and manage your practice.

I’m going to try to avoid the debates about whether these tools are replacing traditional methods or just enhancing them. Instead, I’ll focus on the fact that these CRM platforms can now deliver exceptional results for firms of all sizes, helping you manage more clients efficiently while actually improving the quality of service you provide.

It’s worth taking a few days to test drive one of these accounting CRMs, even just so you can appreciate how much time you could be saving. Whether you like it or not, client expectations have shifted, and they now expect the same seamless digital experience from their CPA that they get from other service providers.

The best CRM software for CPAs and tax professionals

TaxDome for the most comprehensive all-in-one solution

Financial Cents for workflow automation and ease of use

Canopy for tax resolution and IRS integration

How do CRM systems for accountants work?

All these accounting CRM platforms start with a central database of your client information, but they go far beyond being just a digital rolodex. They integrate document management, task tracking, client communication, and billing into one unified system. This opens up incredible possibilities for efficiency, since you can move from reviewing a client’s documents to sending them an invoice to scheduling their next appointment, all without switching between different applications.

Modern accounting CRMs work by creating a single source of truth for all client interactions. When a client emails you, uploads a document, pays an invoice, or completes a task, it’s all tracked in their profile. Your team can see the complete history of interactions, upcoming deadlines, and outstanding items at a glance.

Most accounting CRM platforms work in a pretty similar way at their core. They start with robust contact management, add layers of automation for repetitive tasks, and then integrate with the other tools you already use, like QuickBooks, tax software, and document storage solutions. By connecting these systems, they eliminate the need for duplicate data entry and reduce the risk of errors.

The next step is actually implementing the CRM in your practice. The latest generation of accounting CRMs typically offers comprehensive onboarding support, pre-built templates for common workflows, and intuitive interfaces that even the least tech-savvy team members can master. It’s kind of like upgrading from a filing cabinet to a smart assistant that knows exactly what each client needs and when they need it.

Before we dive in: I don’t want to oversell things. What these CRM platforms can do is genuinely impressive, but they’re not going to magically solve every practice management challenge overnight. If you need to completely overhaul your processes, implementing a CRM will take time and commitment from your entire team. But if you’re looking to streamline operations, improve client communication, and scale your practice more efficiently, these tools can absolutely help.

What makes the best CRM for CPAs?

How we evaluate and test apps

Our best apps roundups are written by humans who’ve spent much of their careers using, testing, and writing about software. We spend dozens of hours researching and testing apps, using each app as it’s intended to be used and evaluating it against the criteria we set for the category. We’re never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the apps we review.

There’s a reason that accounting-specific CRMs have become essential for modern firms: generic CRMs simply don’t understand our industry’s unique needs. Tax deadlines, document retention requirements, IRS communications, and seasonal workflows require specialized features that sales-focused CRMs can’t provide.

Now that these accounting CRMs have matured, there’s real competition between different platforms. They’ve significantly increased in quality and can now handle complex multi-entity clients, automated workflows, and even direct IRS integrations. If all you care about is features, any of the top platforms will impress. But we’ve reached the stage where other factors like pricing, ease of use, and specific integrations matter more than ever.

So, to find the best CRM software for CPAs and tax professionals, I set some specific criteria:

I was looking for platforms designed specifically for accounting professionals, not generic CRMs with accounting features bolted on. Tools that understand tax seasons, compliance requirements, and the importance of secure document management were essential.

I was looking at comprehensive practice management solutions, not just contact databases. The best accounting CRMs integrate client management with workflows, documents, billing, and communication in one platform.

Aside from all that, I also considered how easy each CRM is to use, what kind of support and training they provide, their pricing models (especially how they scale as your firm grows), integration capabilities with essential accounting software, and most important of all: how well do they actually work in a real accounting practice?

I’ve been using and writing about practice management software since firms started their digital transformation, and I’ve watched as these tools evolved from nice-to-haves to essential infrastructure. But writing this article was actually the first time I’ve done such a detailed comparison of the leading platforms head-to-head. The results were fascinating, and I’m happy to say all three platforms on this list offer genuine value for different types of firms.

How to use CRM software in your accounting practice

Interested in streamlining your practice but not sure where to start? Here are a few ways accounting firms are transforming their operations with CRM software:

- Automating client onboarding and data collection

- Tracking project status and deadlines across the team

- Creating standardized workflows for recurring services

- Managing document requests and follow-ups automatically

- Integrating billing and payment collection

- Building stronger client relationships through consistent communication

The best CRM software for CPAs at a glance

| Software | Best for | Access options | Price | Key Features |

|---|---|---|---|---|

| TaxDome | Comprehensive all-in-one solution | Web app; Mobile apps | From $50/user/month | Unlimited storage, IRS integration, workflow automation |

| Financial Cents | Workflow automation and ease of use | Web app | From $19/month (solo) | QuickBooks integration, automated reminders, capacity planning |

| Canopy | Tax resolution and IRS tools | Web app; Mobile apps | From $60/user/month | Direct IRS transcript pulls, tax resolution cases, document management |

The best all-in-one CRM for accounting firms

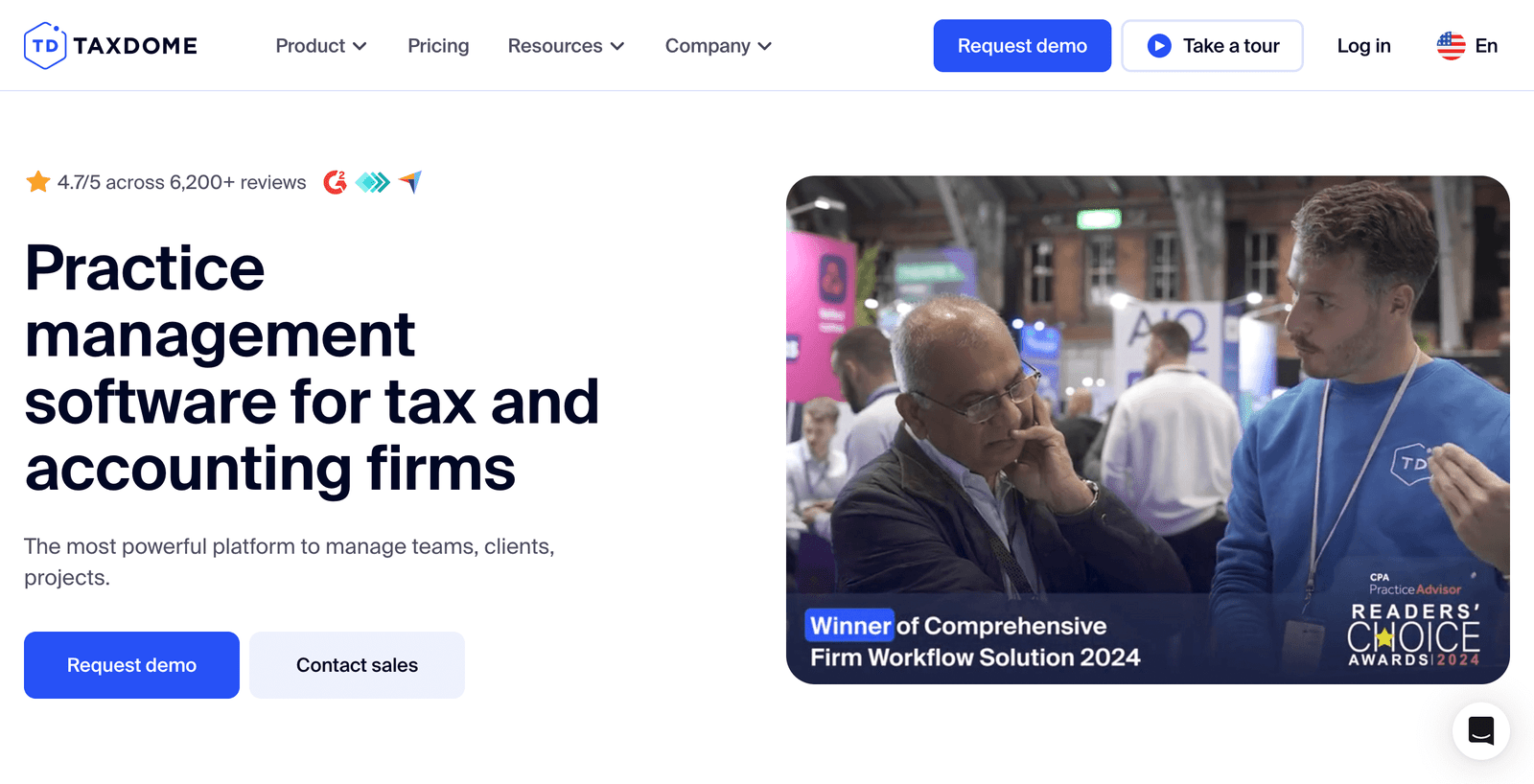

TaxDome

TaxDome pros:

- Truly all-in-one platform with no need for additional tools

- Unlimited document storage and CRM contacts included

- Built specifically for tax and accounting professionals

- White-label options for firm branding

TaxDome cons:

- Steeper learning curve due to comprehensive features

- Annual billing requirement (no month-to-month option)

- Can be overwhelming for very small firms

After years of juggling multiple software subscriptions, TaxDome offers all-in-one accounting practice management software for accountants, tax professionals, and bookkeeping firms. What sets TaxDome apart is its commitment to being a true all-in-one solution, you won’t need separate tools for CRM, document management, billing, or client portals.

TaxDome excels at bringing order to the chaos of tax season. The convenience these systems provide explains why there are so many options today, but TaxDome stands out with its comprehensive approach. Every feature you need is included in the base price: unlimited document storage, unlimited CRM contacts, e-signatures, client portal, workflow automation, and more.

The platform’s workflow automation capabilities are particularly impressive. You can create templates for any recurring process, from onboarding new clients to preparing tax returns, and the system will automatically move work through each stage, assign tasks to team members, and send reminders to clients for missing information. With client management tools like a secure portal, integrated messaging, automated reminders, and organized data storage, TaxDome makes it simple to build strong relationships and offer a better client experience.

TaxDome also offers excellent value for growing firms. While the per-user pricing might seem steep initially, when you factor in that it replaces multiple other subscriptions and includes unlimited storage and contacts, it often works out to be more economical than piecing together separate solutions.

TaxDome pricing: Year one starts at $800/year.

The best CRM for workflow automation

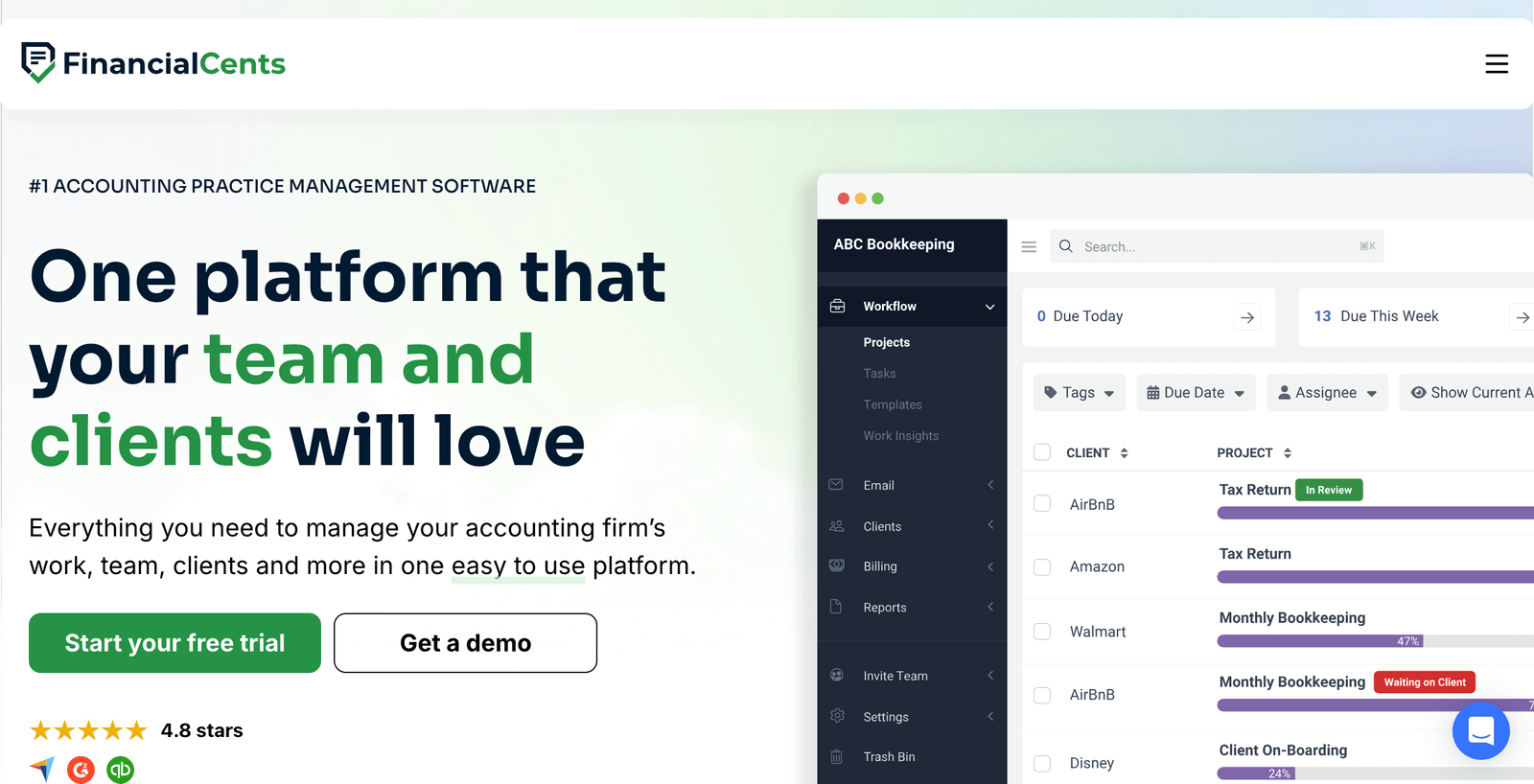

FinancialCents

Financial Cents pros:

- Exceptional ease of use with minimal learning curve

- Excellent value for solo practitioners

- Strong QuickBooks Online integration

- Automated client follow-ups save significant time

Financial Cents cons:

- Limited advanced features compared to competitors

- Invoicing capabilities could be more robust

- No direct IRS integration

For firms that prioritize simplicity and efficiency, Financial Cents hits the sweet spot between functionality and usability. Financial Cents delivers streamlined accounting practice management with a focus on making complex workflows simple.

What I love about Financial Cents is how quickly you can get up and running. Unlike some platforms that require weeks of setup and training, Financial Cents provides pre-built templates for common accounting workflows that you can implement immediately. The interface is refreshingly intuitive, your team will actually use it rather than finding workarounds.

One of the best features of Financial Cents is the ability to give clients a to-do item and have the system automatically follow up until they get it done. This alone can save hours of back-and-forth emails during busy season. The system sends gentle reminders at intervals you specify, and you can see at a glance which clients have outstanding items.

The QuickBooks Online integration deserves special mention. If you’re already using QBO, Financial Cents seamlessly pulls in your client list and can even track key performance indicators for your clients. This creates interesting opportunities for advisory services beyond traditional compliance work.

For solo practitioners, the pricing is particularly attractive. The Solo Plan is affordable for individual practitioners at just $19/month, including core features like workflow automation, client portal, and document management. This makes it accessible even for new firms just starting out.

FinancialCents pricing: Team plan at $69/user/month.

The best CRM for tax resolution

Canopy

Canopy pros:

- Exceptional tax resolution tools with direct IRS integration

- Modular pricing lets you pay only for what you need

- Strong document management capabilities

- Excellent mobile apps for both firms and clients

Canopy cons:

- Recent pricing changes have frustrated some users

- Can get expensive with multiple modules

- Setup can be complex for smaller firms

Canopy is a cloud-based accounting practice management software with CRM, document management, a client portal app, workflow, payments, time and billing. But where Canopy really shines is in its tax resolution capabilities.

If you regularly deal with IRS matters, Canopy’s tax resolution features are game-changing. The built-in Client Portal functionality, coupled with the ability to pull IRS transcripts directly from the IRS into Canopy (via their “Tax Resolution” module) were key selling points that set it apart from competitors. You can pull transcripts, manage notices, and handle resolution cases all within the platform.

The modular pricing structure is both a strength and potential weakness. Canopy offers modular pricing for our productivity-boosting, growth-driving practice management software. Start with the Client Engagement Platform as your base, then go nuts: pick one, two, or all the modules to customize Canopy to fit your practice. This means you’re not paying for features you don’t need, but costs can add up quickly if you want the full suite.

Canopy’s document management deserves special recognition. Reviewers appreciate Canopy’s document storage capabilities for its unlimited storage, ease of use, and strong security. The ability to work with documents directly in the platform, including markup and annotations, eliminates the need for separate PDF editing software.

The mobile experience is particularly well-executed. Both the firm app and client portal app are polished and functional, making it easy to work on the go or for clients to upload documents from their phones. The best feature is the client portal and mobile app. It has been a business transformation blessing, according to long-time users.

Canopy pricing: Modular pricing starting at $60/user/month for smaller firms. Enterprise and custom pricing available for larger firms. Free trial available.

Other CRM options worth considering

While the three platforms above are my top picks, several other solutions deserve mention:

Karbon: Excellent for larger firms needing advanced collaboration features. Particularly strong in email management and team communication.

Jetpack Workflow: Simple and affordable, great for firms wanting basic client tracking without the complexity.

HubSpot CRM: While not accounting-specific, its free tier can work for very small firms needing basic CRM capabilities.

QuickBooks Online Accountant: If you’re already deep in the QuickBooks ecosystem, their practice management tools might be sufficient.

How to choose and implement a CRM

Selecting the right CRM for your firm requires careful consideration of several factors:

Assess your current pain points

Before shopping for solutions, identify what’s not working in your current process. Are you losing track of client communications? Missing deadlines? Spending too much time on data entry? Your pain points will guide your feature priorities.

Consider your firm’s size and growth plans

Solo practitioners have different needs than 20-person firms. Although there are a few CRMs ideal for small firms or solo professionals, monday CRM is among the most flexible options, with pricing that scales. Choose a platform that can grow with you.

Evaluate integration needs

Make a list of your essential software (tax prep, QuickBooks, document storage) and ensure your CRM can integrate with them. Seamless data import capabilities for easy migration of data from previous CRM systems, documents such as spreadsheets, and integrations with essential software including QuickBooks, Zapier, Calendly, Outlook, and more are crucial for smooth operations.

Plan your implementation

Successful CRM implementation requires commitment from your entire team. Set aside time for training, start with a pilot group or service line, and gradually expand usage as comfort grows.

The security and compliance implications

When choosing a CRM for your accounting firm, security should be paramount. You’re handling sensitive financial data, social security numbers, and confidential business information.

Most leading CRMs offer strong security measures like encryption, role-based access, and audit trails. All three platforms on this list meet or exceed industry standards for data protection, including SOC 2 Type II certification and bank-level encryption.

Remember to verify that any CRM you choose complies with your state’s data protection requirements and IRS guidelines for tax professionals. Also consider whether you need features like IP whitelisting, two-factor authentication, and detailed audit logs for compliance purposes.

What’s next for accounting CRMs?

The accounting CRM space is evolving rapidly, with artificial intelligence and automation becoming increasingly sophisticated. We’re seeing platforms add AI-powered features for document extraction, predictive analytics for client needs, and even automated response suggestions for client communications.

The integration between CRMs and other accounting tools continues to deepen. Soon, we might see CRMs that can automatically prepare tax returns based on uploaded documents, or systems that predict which clients are likely to need additional services based on their financial patterns.

Mobile capabilities are also expanding quickly. Clients increasingly expect to handle everything from their phones, and CRM platforms are responding with more robust mobile apps that offer nearly full functionality.

Making your decision

Choosing a CRM is a significant decision that will impact your firm’s operations for years to come. Here’s my advice:

If you want the most comprehensive solution and don’t mind a learning curve, TaxDome offers exceptional value with its all-inclusive pricing and unlimited storage.

If ease of use and quick implementation are your priorities, Financial Cents provides an excellent balance of features and simplicity, especially for smaller firms.

If you handle significant tax resolution work or need modular pricing flexibility, Canopy offers specialized tools that can transform how you manage IRS matters.

Remember, most platforms offer free trials. Take advantage of these to test each system with your actual workflows before committing. The best CRM for your firm is the one your team will actually use consistently.

The investment in a good CRM, both financial and time, pays dividends in improved efficiency, better client service, and the ability to scale your practice without proportionally scaling your stress levels. In today’s competitive environment, it’s not just about working harder, it’s about working smarter. And that’s exactly what the right CRM enables you to do.