I’ve witnessed firsthand how the right accounting software can make or break a mid-sized law firm’s financial operations. The challenge isn’t just finding software that handles basic bookkeeping, it’s about selecting a solution that scales with your practice, ensures compliance, and provides the strategic insights that drive profitable growth.

The stakes couldn’t be higher. Mid-sized law firms, those with 25 to 150 attorneys, face unique financial complexities that smaller practices don’t encounter, yet they lack the resources of large firms to build custom solutions. The wrong software choice can cost firms hundreds of thousands in lost billable hours, compliance issues, and missed opportunities.

Throughout my career, I’ve helped numerous law firms navigate these critical technology decisions. The firms that succeed choose software that goes beyond basic accounting to become a strategic business intelligence platform.

Why Software Selection Matters More Than Ever

Before diving into specific solutions, let’s address the elephant in the room: why does accounting software matter so much for mid-sized law firms? The answer lies in the unique financial challenges these firms face.

Unlike small practices that can manage with basic bookkeeping, mid-sized firms must handle complex trust accounting, sophisticated billing arrangements, multi-jurisdictional compliance requirements, and detailed profitability analysis. Furthermore, these firms are typically experiencing rapid growth, making scalability a critical concern.

In my experience, firms that make the right software choice see average productivity gains of 35% in their finance departments, while those that choose poorly often face years of operational inefficiency and compliance headaches. The cost of switching software later can exceed $500,000 when you factor in data migration, training, and lost productivity.

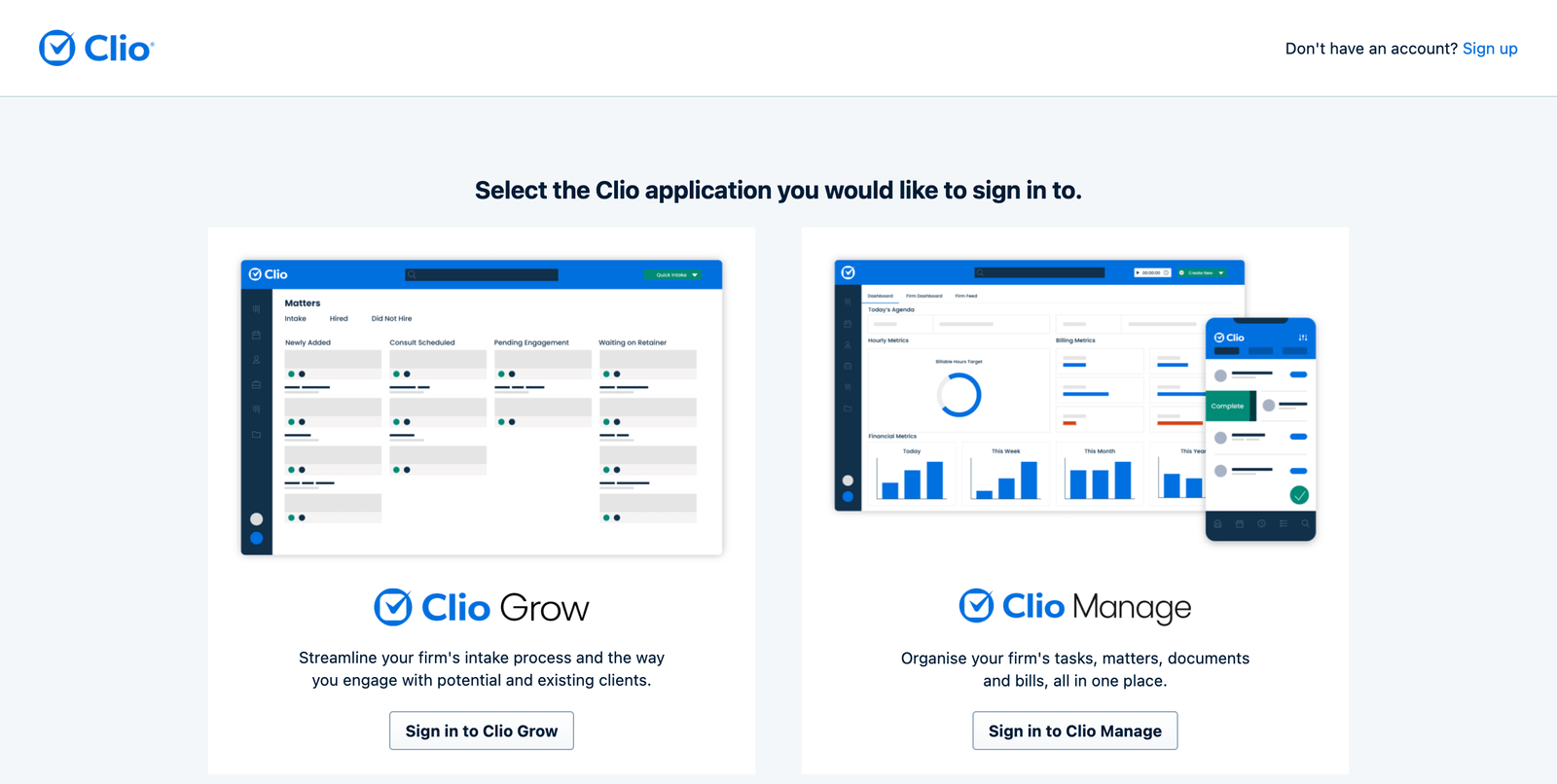

Clio Manage – The Cloud-Native Powerhouse

Clio has emerged as the dominant force in legal practice management, and for good reason. Their comprehensive platform combines robust accounting capabilities with case management, making it particularly attractive for mid-sized firms seeking an integrated solution.

Why Clio Excels for Mid-Sized Firms:

The platform’s cloud-native architecture ensures automatic updates, robust security, and seamless remote access, critical factors in today’s hybrid work environment. Clio’s trust accounting module meets all jurisdictional requirements while providing real-time compliance monitoring that prevents costly violations.

Key Financial Management Features:

- Advanced trust accounting with three-way reconciliation

- Automated billing with customizable invoice templates

- Real-time financial reporting and analytics

- Integration with 200+ third-party applications

- Mobile access for attorneys and staff

Firms using Clio report average billing efficiency improvements of 25% and reduced collection times by 30%. The platform’s analytics capabilities provide partners with unprecedented visibility into matter profitability and attorney performance.

Investment Considerations: Clio’s pricing starts at $89 per user monthly for their advanced plan, making it cost-effective for firms with 25-100 attorneys. The return on investment typically occurs within 12-18 months through improved billing efficiency and reduced administrative overhead.

QuickBooks Enterprise – The Familiar Favorite

While QuickBooks Enterprise isn’t specifically designed for legal practices, many mid-sized firms find success with this robust accounting platform when paired with legal-specific add-ons.

Strategic Advantages: The platform’s widespread adoption means finding qualified staff is easier, and integration options are virtually limitless. QuickBooks Enterprise can handle up to 30 users simultaneously and manages databases with millions of transactions, sufficient for most mid-sized firms.

Customization Capabilities: Advanced reporting features allow firms to create custom financial dashboards that track key performance indicators specific to legal practice. The platform’s job costing functionality can be adapted to track matter profitability, while its inventory management features work well for firms managing physical assets.

Investment Analysis: At approximately $1,500 annually for the base version, QuickBooks Enterprise offers exceptional value for firms prioritizing cost control. However, customization and integration costs can increase the total investment significantly.

NetSuite – The Enterprise-Grade Solution

For mid-sized firms with complex operations or aggressive growth plans, NetSuite represents the gold standard in accounting software. This comprehensive ERP solution provides capabilities that rival systems used by Fortune 500 companies.

Transformative Capabilities: NetSuite’s modular architecture allows firms to implement core accounting functionality initially and add modules like project management, CRM, and advanced analytics as they grow. The platform’s real-time financial consolidation capabilities are particularly valuable for firms with multiple offices or practice areas.

Professional Services Optimization: The platform’s project accounting module provides sophisticated time and expense tracking, advanced billing options, and detailed profitability analysis. Resource planning tools help firms optimize attorney utilization and identify capacity constraints before they impact client service.

Strategic Investment: NetSuite’s pricing starts around $99 per user monthly, but full implementations typically range from $100,000 to $500,000. While the initial investment is substantial, firms often see ROI within 24-36 months through improved operational efficiency and better decision-making capabilities.

Sage Intacct – The Accounting Professional’s Choice

Sage Intacct has earned recognition as the preferred accounting software among CPAs and financial professionals, making it an excellent choice for mid-sized law firms with sophisticated accounting needs.

Core Strengths: The platform’s dimensional reporting capabilities allow firms to analyze financial performance across multiple dimensions simultaneously, by attorney, practice area, client, and office location. This level of analysis provides insights that drive strategic decision-making.

Compliance and Controls: Intacct’s robust internal controls and audit trail capabilities satisfy the most stringent compliance requirements. The platform’s automated close processes can reduce month-end closing time by 50%, allowing finance teams to focus on analysis rather than data processing.

Integration Excellence: With over 200 pre-built integrations, Intacct connects seamlessly with popular legal software like iManage, LexisNexis, and Westlaw. This connectivity eliminates manual data entry and ensures information consistency across systems.

Xero – The User-Friendly Alternative

Xero’s intuitive interface and strong automation capabilities make it an attractive option for mid-sized firms prioritizing ease of use and operational efficiency.

Automation Advantages: The platform’s bank reconciliation automation can process thousands of transactions daily, while its invoice approval workflows ensure proper authorization controls. Smart categorization features learn from user behavior to automatically classify transactions.

Collaborative Features: Xero’s multi-user capabilities and permission controls allow firms to provide appropriate access to attorneys, staff, and external advisors. The platform’s advisor portal facilitates collaboration with external CPAs and consultants.

Value Proposition: At $70 per month for unlimited users, Xero offers exceptional value for firms seeking professional-grade accounting software without enterprise-level complexity.

FreshBooks – The Billing Specialist

For firms where billing efficiency is the primary concern, FreshBooks provides exceptional time tracking and invoicing capabilities that can transform revenue collection.

Billing Excellence: The platform’s time tracking features integrate seamlessly with popular legal applications, ensuring accurate capture of billable hours. Automated payment reminders and online payment processing reduce collection times significantly.

Client Communication: FreshBooks’ client portal allows clients to view invoices, make payments, and track project progress, reducing administrative inquiries and improving client satisfaction.

Zoho Books

Zoho Books offers mid-sized firms the unique advantage of integrating with the entire Zoho ecosystem, providing CRM, project management, and document management capabilities in addition to accounting.

Integrated Approach: The platform’s integration with Zoho CRM provides complete client lifecycle management, while Zoho Projects handles matter management and collaboration. This integrated approach eliminates data silos and improves operational efficiency.

Scalability Features: Zoho Books’ modular pricing allows firms to start with basic accounting features and add capabilities as needed. The platform’s multi-currency and multi-location capabilities support firms with international operations.

Strategic Implementation Recommendations

Based on my experience helping firms navigate these decisions, I recommend a phased approach to software selection and implementation. Start by conducting a comprehensive needs assessment that includes input from attorneys, staff, and clients. This assessment should identify current pain points, future growth plans, and specific compliance requirements.

Next, create a detailed evaluation matrix that weights different features based on your firm’s priorities. Don’t just focus on current needs, consider where your firm wants to be in five years. The software you choose today should support your growth objectives and strategic initiatives.

Finally, invest in comprehensive training and change management. The most sophisticated software won’t deliver value if your team doesn’t adopt it effectively. Plan for at least 20% of your implementation budget to go toward training and support.

Selecting the right accounting software represents one of the most critical technology decisions a mid-sized law firm will make. The solution you choose will impact every aspect of your financial operations, from daily billing processes to strategic planning and compliance management.

The seven solutions outlined in this guide represent the current best options for mid-sized law firms, each offering unique advantages depending on your specific needs and objectives. Whether you prioritize integration capabilities, user-friendliness, or enterprise-grade functionality, there’s a solution that can transform your firm’s financial operations.

The key to success lies not just in selecting the right software, but in implementing it strategically and ensuring organization-wide adoption. Firms that approach this decision thoughtfully, with proper planning and executive support, typically see significant returns on their investment within the first two years.

The legal profession continues to evolve rapidly, and the firms that thrive will be those that leverage technology to operate more efficiently, serve clients better, and make data-driven decisions. The accounting software you choose today will play a crucial role in positioning your firm for success in the years ahead.

Frequently Asked Questions

Q: How do I determine which software is right for my firm’s size and complexity?

A: Start by documenting your current financial processes, identifying pain points, and defining growth objectives. Firms with fewer than 50 attorneys often succeed with solutions like Clio or Xero, while larger firms typically benefit from NetSuite or Sage Intacct’s advanced capabilities.

Q: What’s the typical implementation timeline for mid-sized law firms?

A: Implementation timelines vary significantly based on software complexity and data migration requirements. Simple solutions like FreshBooks can be implemented in 2-4 weeks, while enterprise solutions like NetSuite may require 6-12 months for full deployment.

Q: How can firms ensure successful software adoption across their organization?

A: Success requires comprehensive change management, including executive sponsorship, user training, and clear communication about benefits. Firms should also designate software champions who can provide ongoing support and training.

Q: What are the most important features to prioritize when evaluating accounting software?

A: Trust accounting compliance, matter profitability tracking, automated billing, and robust reporting capabilities represent the most critical features for legal practices. Integration capabilities and scalability should also be high priorities.

Q: How do I justify the software investment to my partners?

A: Focus on quantifiable benefits like reduced billing time, improved collection rates, and enhanced compliance. Most quality accounting software pays for itself within 18-24 months through operational efficiencies and improved cash flow.