Managing social media for your accounting firm doesn’t have to consume your entire day. With the right tools and strategy, you can maintain an engaging online presence, attract new clients, and build trust in your community, all in just 10 minutes daily.

The secret lies in automation, smart content planning, and AI-powered tools that handle the heavy lifting while you focus on what you do best: providing excellent financial expertise and accounting services.

Here’s everything you need to know about streamlining your accounting firm’s social media management.

What Makes Accounting Social Media Unique?

Accounting firms face unique challenges on social media. You need to build trust with potential clients, showcase your expertise, and maintain professional standards while staying engaging and approachable.

Unlike other businesses, accounting firms must balance educational content about tax and financial issues, showcase client success stories (while maintaining client confidentiality), and address common financial concerns, all while complying with professional ethics standards and maintaining client privilege.

This is where strategic automation becomes essential. You can’t afford to spend hours crafting posts when you have clients to serve and tax returns to prepare, but you also can’t neglect your online presence when 87% of potential clients research accounting firms online before making contact.

Essential Social Media Platforms for Accounting Firms

Not all social media platforms are created equal for accounting practices. Here’s where you should focus your efforts:

LinkedIn: Your primary platform for professional networking, thought leadership, and B2B client acquisition. LinkedIn’s professional environment is perfect for financial content and industry discussions.

Facebook: Excellent for community engagement, client testimonials, and local visibility. Facebook’s local business features help clients find your firm and read reviews.

Google My Business: While not traditional social media, it’s crucial for local SEO and client reviews. Regular posts here improve your search visibility.

Twitter/X (optional): If your practice focuses on current events, tax law changes, or financial commentary, Twitter can be effective for real-time financial insights and news commentary.

YouTube (optional): For firms comfortable with video content, YouTube works well for financial education and tax preparation tutorials.

How to Set Up Automated Social Media Management

The foundation of 10-minute daily social media management is automation. Here’s how to set it up:

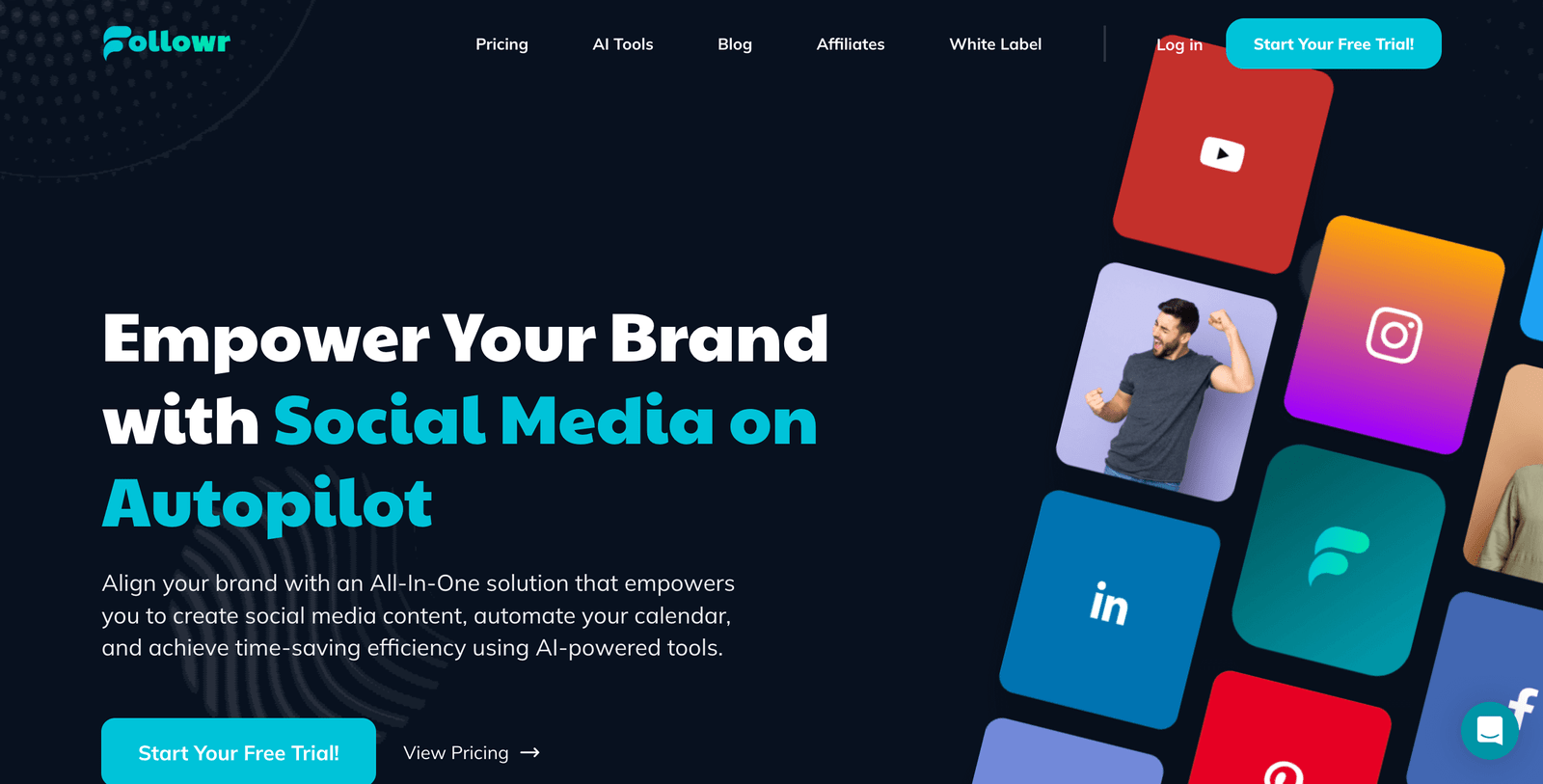

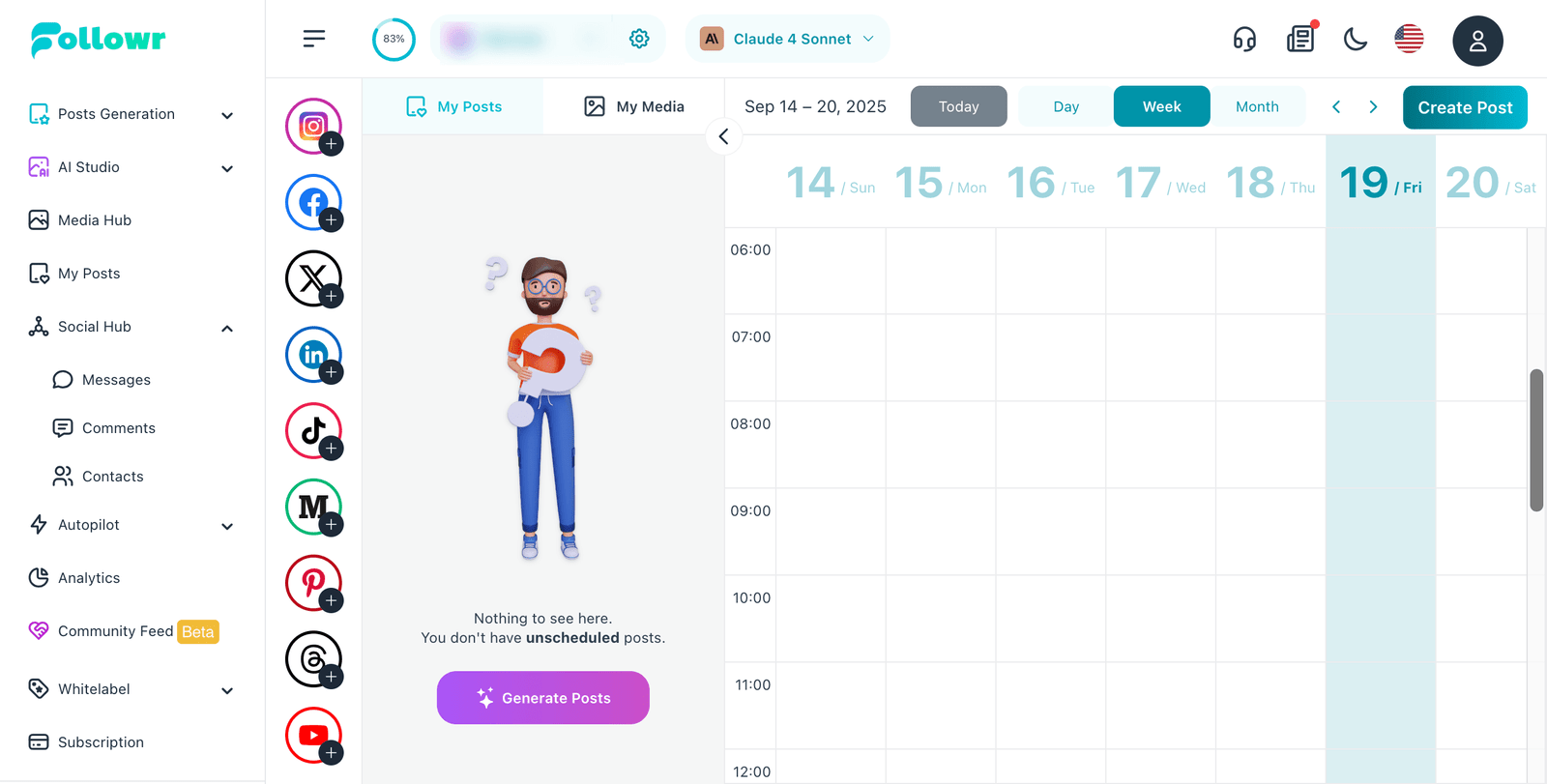

Choose an AI-powered social media management platform

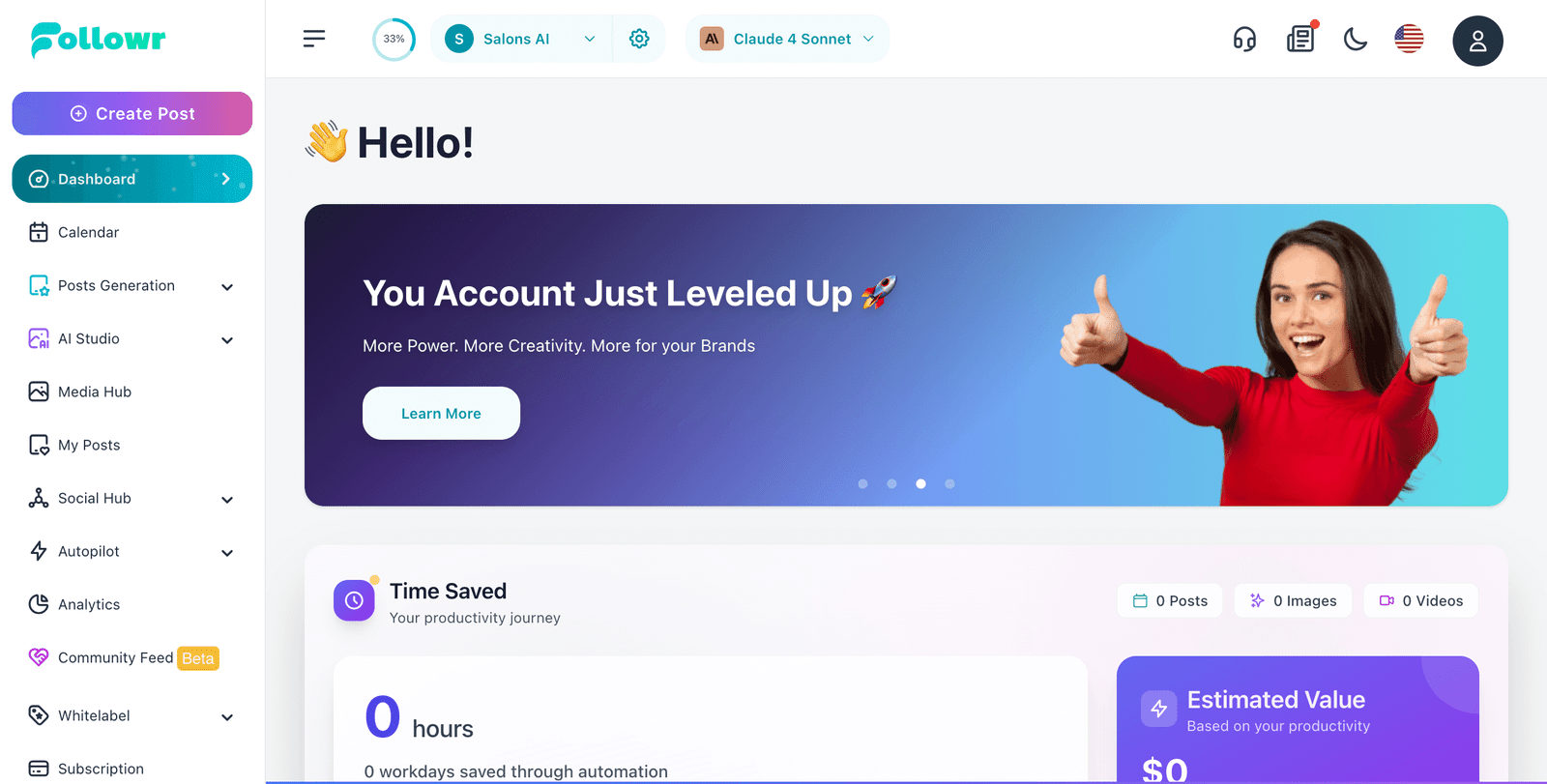

For accounting firms, platforms with AI content generation and financial industry templates work best. Followr.ai offers specialized tools for professional services, including:

- AI-powered content creation with accounting industry templates

- Automated posting schedules optimized for professional engagement

- Compliance-aware content suggestions

- Multi-platform management from one dashboard

Set up your content calendar

Create a monthly content calendar with these essential post types:

Monday: Money Monday (financial tips and tax updates)

Tuesday: Tax Tip Tuesday (tax planning and preparation advice)

Wednesday: Financial FAQ Wednesday (answer common accounting questions)

Thursday: Team Thursday (introduce CPAs and staff)

Friday: Financial News Friday (industry updates or community events)

Batch create content monthly

Spend 2-3 hours once per month creating content for the entire month. Use AI tools to generate:

- Educational posts about common accounting and tax issues

- Industry news commentary and analysis

- Firm updates and announcements

- Client success stories (with permission and anonymization)

- Financial process explanations

- Seasonal tax reminders and deadlines

Creating Engaging Financial Content in Minutes

With AI-powered tools, creating professional accounting content takes minutes instead of hours. Here’s your streamlined process:

Use AI content generators

Modern platforms can generate accounting-specific content based on prompts. For example, you can input “Create a post about the importance of quarterly tax planning” and receive professionally written content with relevant hashtags.

Leverage content templates

Pre-made templates for accounting firms save significant time. Common templates include:

- Tax tip infographics

- Financial planning process graphics

- CPA introduction posts

- Client success story formats

- Tax deadline reminders

- Bookkeeping best practice posts

Repurpose educational content

Transform one piece of educational content into multiple posts:

- A blog post about tax deductions becomes a LinkedIn article series

- A financial FAQ becomes multiple Twitter threads

- A case study becomes an Instagram carousel post

- A tax webinar becomes multiple short-form video clips

Using AI Tools for Accounting Social Media

AI tools specifically designed for professional services can revolutionize your social media efficiency:

AI Writing Assistance

Generate professional, financially accurate content instantly. Input basic information about an accounting topic, and AI creates engaging posts while maintaining professional standards and avoiding unauthorized practice issues.

AI Image Generation

Create custom graphics for tax tips, financial process explanations, and firm announcements without hiring a designer.

Automated Scheduling

AI analyzes your audience engagement patterns and automatically schedules posts for optimal reach and interaction within professional hours.

Content Optimization

AI tools analyze your past performance and suggest improvements for better engagement rates while maintaining professional tone.

Analytics That Matter for Accounting Firms

Track these key metrics to ensure your 10-minute daily investment pays off:

Client Acquisition: How many new client inquiries come from social media

Professional Engagement: Likes, comments, and shares from other professionals and potential clients

Local Reach: How many people in your service area see your content

Website Traffic: Social media clicks that lead to your website

Referral Generation: Professional connections and referrals attributed to social media presence

Most AI-powered platforms provide automated analytics reports, so you can track these metrics without manual calculations.

Your 10-Minute Daily Social Media Routine

Here’s your streamlined daily workflow:

Minutes 1-3: Check and respond

- Review comments and messages from the previous day

- Respond to client inquiries professionally

- Thank clients for positive reviews

- Engage with professional connections

Minutes 4-6: Content review and adjustment

- Check the day’s scheduled posts

- Make minor adjustments if needed (breaking tax news, firm updates)

- Ensure all posts align with your firm’s voice and compliance requirements

Minutes 7-10: Engagement and monitoring

- Engage with local business posts and accounting community discussions

- Monitor brand mentions and respond appropriately

- Check analytics for any trending posts to replicate success

- Share relevant financial news or commentary

Weekly 30-minute session

Once weekly, spend 30 minutes:

- Analyzing performance metrics

- Planning next week’s content adjustments

- Updating your content calendar based on tax developments or firm changes

- Reviewing compliance and professional responsibility guidelines

Automation Features

Take your efficiency further with these advanced features:

Automated Client Education Series

Set up automated sequences that educate potential clients about financial processes throughout the year. These can include:

- Tax preparation tips and deadline reminders

- Explanation of accounting procedures and timelines

- Seasonal financial advice (year-end planning, quarterly estimated taxes, etc.)

- Industry-specific accounting updates

Smart Content Curation

AI tools can identify trending financial topics and suggest timely content. This ensures your firm stays current with accounting industry discussions and breaking news.

Integrated Review Management

Automate requests for client reviews while maintaining compliance with professional ethics and client confidentiality rules.

Compliance and Best Practices

When automating accounting social media, always maintain:

Professional Ethics Compliance: Follow AICPA and state board rules for CPA advertising and marketing

Client Confidentiality: Never post client information without explicit written consent and proper anonymization

Professional Standards: Maintain professional language and avoid giving specific financial advice

Accurate Financial Information: Ensure all financial information is current and includes appropriate disclaimers

State Board Guidelines: Follow your jurisdiction’s specific rules for CPA social media use

Tools and Resources

Here are essential tools for accounting social media automation:

Primary Platform: Followr.ai – AI-powered social media management specifically designed for professional services

Analytics: Built-in analytics dashboard for performance tracking

Content Creation: AI writing assistant for financially appropriate content

Image Generation: AI image tools for custom financial graphics

Scheduling: Automated posting calendar optimized for professional engagement

Compliance Checking: Built-in guidelines for CPA advertising compliance

Measuring Success

Your 10-minute daily investment should yield measurable results:

Month 1-2: Establish consistent posting schedule and build content library

Month 3-4: See increased engagement and local professional visibility

Month 6+: Track new client acquisitions directly from social media efforts

Most accounting firms see a 45-65% increase in social media engagement and a 30-40% increase in online client inquiries within six months of implementing automated social media management.

Frequently Asked Questions

Q: Is 10 minutes really enough for effective social media management?

A: When you use AI-powered automation tools designed for professional services. The key is front-loading your content creation and letting automation handle distribution and scheduling while maintaining compliance.

Q: What if I need to post urgent tax updates or firm news?

A: Most automation platforms allow real-time posting alongside scheduled content. You can quickly override your schedule for urgent announcements or breaking tax news.

Q: How do I ensure content stays compliant with CPA professional standards?

A: Choose platforms that understand accounting marketing requirements. AI tools designed for accounting firms include compliance checks and suggestions based on professional ethics rules.

Q: Can automated tools handle potential client questions and comments?

A: While AI can draft responses, always review and personalize replies to potential client inquiries. Use automation for scheduling and content creation, not client communication. Never give specific financial advice through social media.

Q: What’s the ROI of social media for accounting firms?

A: Most accounting firms see 400-600% ROI from social media when managed effectively. A single new client typically covers months or even years of social media management costs.

Q: How often should I update my automated content calendar?

A: Review monthly and make adjustments based on tax developments or seasonal needs quarterly. AI-powered tools adapt to trends automatically while maintaining your professional messaging.

Q: Can I manage multiple service areas or office locations with these tools?

A: Most enterprise-level platforms support multiple service areas and locations with area-specific content while maintaining brand consistency across all practices.

Q: What about client confidentiality when sharing case studies or success stories?

A: Always obtain written consent and properly anonymize any client information. Focus on general outcomes and financial principles rather than specific client details.

Social media management for accounting firms doesn’t have to be time-consuming or overwhelming. With the right AI-powered tools and a strategic approach, you can build a strong online presence, attract new clients, and maintain professional excellence, all in just 10 minutes per day.

The investment in automated social media management pays dividends through increased client acquisition, improved professional reputation, and enhanced firm visibility. Start with the fundamentals, leverage AI tools for efficiency, and watch your accounting firm’s online presence flourish while maintaining the highest standards of professional responsibility.