Getting visitors to your accounting firm website is just the first step. The real challenge lies in converting those visitors into actual clients who retain your services and become loyal advocates. Whether you’re a solo CPA or managing a multi-partner firm, turning website traffic into revenue requires the right strategy and tools.

Here’s everything you need to know about converting accounting website visitors into clients and growing your practice.

What Makes Accounting Website Visitors Convert?

Your accounting website visitors are looking for three key things: expertise, trust, and immediate access to professional guidance. They want to schedule consultations quickly, understand your accounting services clearly, and feel confident about choosing your firm for their financial matters.

In practice, this means your website should:

- Provide 24/7 online consultation booking capabilities

- Display clear service information and fee structures

- Showcase client testimonials and CPA credentials

- Offer multiple ways to get in touch for urgent tax matters

- Make it easy to find office locations and hours

- Provide educational content about tax procedures and financial planning

- Show accepted payment methods and billing options

- Enable quick contact for tax emergencies and deadlines

- Display client success stories and case studies (where appropriate)

The most successful accounting firms understand that modern clients expect the same level of digital convenience they get from other professional service providers.

How to Optimize Your Consultation Booking Process

The consultation booking process is where most accounting firm websites lose potential clients. A complicated or time-consuming scheduling system will send visitors straight to your competitors.

Implement 24/7 Online Consultation Scheduling

Your clients don’t just need accounting help during business hours, so why should your booking system be limited to 9-to-5? Online consultation scheduling keeps your firm available for booking around the clock, allowing clients to schedule meetings when it’s convenient for them.

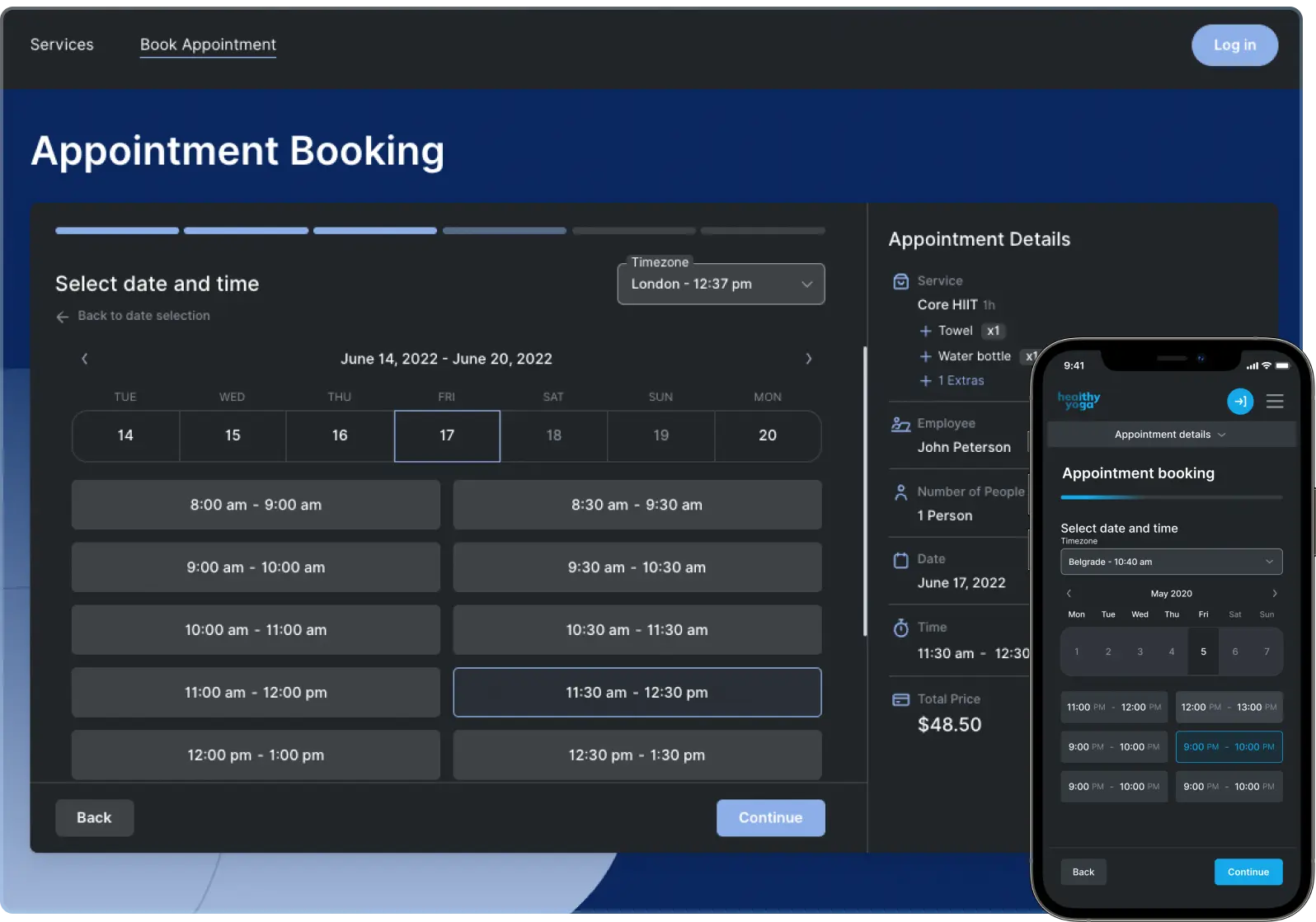

With tools like Trafft, you can provide an exceptional booking experience that works seamlessly across all devices. Potential clients can see your real-time availability and book consultations instantly without phone calls or waiting for office hours.

Simplify Your Consultation Request Form

Keep your initial consultation form focused and professional. Ask for only the essential information:

- Client name and contact information

- Type of accounting need (tax preparation, bookkeeping, business consulting, etc.)

- Preferred consultation date and time

- Brief description of financial situation or business needs

- Urgency level of the matter (tax deadline, audit, etc.)

You can collect detailed financial information and confidentiality details during the consultation confirmation process or when clients arrive for their appointment.

Offer Multiple Booking Channels

Different clients prefer different booking methods. Provide options through:

Website Integration: Embed your booking system directly on your website so visitors don’t need to leave your site to schedule consultations.

Social Media Links: Share your booking link on LinkedIn, Facebook, and other professional platforms where potential clients discover your firm.

QR Codes: Display QR codes in your office, on business cards, and in marketing materials that instantly open your booking page when scanned.

Google Integration: Use Google Reserve to reach potential clients by showcasing your accounting services and availability directly on Google Search and Maps.

Essential Features for Accounting Firm Websites

Your accounting website needs specific features that address the unique needs of clients seeking financial expertise:

Trust-Building Elements

Display your CPA license, professional certifications, and years of practice prominently. Include client testimonials and success stories (following confidentiality guidelines). Show professional association memberships, awards, and continuing professional education commitments.

Service Area Information

Create detailed pages for each service you offer, from tax preparation to financial planning. Include information about what clients can expect, typical project timelines, and fee structures when appropriate.

Tax Season and Emergency Contact Options

Tax deadlines don’t wait for business hours. Provide clear information about tax season availability and emergency contact procedures for urgent financial matters and approaching deadlines.

Fee and Payment Information

Make it easy for clients to understand your fee structure and what payment options are available. Consider offering payment plans for larger engagements or monthly retainer arrangements for ongoing services.

Streamlining Consultation Scheduling

Modern scheduling software can dramatically improve your conversion rates by making the booking process effortless for potential clients.

Automated Confirmations and Reminders

Reduce no-shows and improve client satisfaction by automatically sending confirmation emails and SMS reminders before consultations. This professional touch shows you value clients’ time and helps them prepare for meetings with relevant financial documents.

CPA Calendar Management

If you have multiple CPAs or accounting staff, manage all calendars from one dashboard. This prevents double-bookings and ensures potential clients can easily find available consultations with their preferred accountant or service specialist.

Multi-Office Support

For accounting firms with multiple locations, use scheduling software that can manage all offices in one system. Clients can easily compare availability across locations and choose what works best for them.

Managing Client Communications Effectively

Effective communication builds relationships that convert visitors into long-term clients.

Client Relationship Management

Maintain detailed client records including service history, communication preferences, and important financial dates. Send tax deadline reminders, financial planning updates, and firm newsletters to keep your practice top-of-mind.

Educational Content

Share financial insights, tax procedure explanations, and answers to common accounting questions through blog posts, emails, and social media. Educated clients are more likely to seek proactive financial planning and refer others to your firm.

Follow-Up Systems

Implement automated follow-up sequences for different client interactions:

- Welcome series for new clients

- Tax deadline and filing reminders

- Quarterly business check-ins

- Follow-up on potential service evaluations

- Annual financial planning reviews

Building Trust with Potential Clients

Trust is crucial in financial service decisions. Build confidence through:

Professional Website Design

Your website is often the first impression potential clients have of your firm. Invest in a clean, professional design that reflects the quality of accounting services you provide.

Transparent Fee Information

When possible, provide clear information about consultation fees, retainer requirements, and billing practices. This transparency builds trust and helps clients make informed decisions about financial services.

Client Reviews and Testimonials

Encourage satisfied clients to leave reviews on Google, Yelp, and other business directories (following confidentiality guidelines). Display positive testimonials prominently on your website while respecting client privacy.

CPA Introductions

Include professional photos and detailed bios of your accounting team, including education, CPA licenses, and areas of expertise. Clients want to know who will be handling their financial matters and feel confident in their accountant’s qualifications.

Measuring and Improving Conversion Rates

Track these key metrics to understand and improve your website’s performance:

- Conversion Rate: Percentage of visitors who schedule consultations

- Consultation Show Rate: Percentage of scheduled clients who actually attend

- Source Analysis: Which marketing channels bring the highest-converting visitors

- Page Performance: Which service pages keep visitors engaged longest

- Booking Abandonment: Where in the scheduling process do people drop off

- Client Retention: Percentage of consultations that result in retained clients

Use tools like Google Analytics to monitor website performance and consultation scheduling analytics to track booking patterns.

Regular analysis helps you identify what’s working and what needs improvement in your conversion strategy.

Getting Started with Better Conversions

Converting accounting firm website visitors into clients requires the right combination of user-friendly technology, clear communication, and professional financial services. Start by implementing online consultation scheduling that works 24/7, streamline your booking process, and focus on building trust through transparency and excellent client communication.

The accounting firms that thrive in today’s digital world are those that make it incredibly easy for clients to choose them, schedule consultations, and receive financial guidance. By optimizing each step of the client journey from initial website visit to ongoing accounting services, you’ll see more conversions and build a stronger, more profitable practice.

Ready to improve your accounting firm’s conversion rates? Consider implementing comprehensive scheduling software like Trafft that handles online bookings, client communications, and practice management all in one platform. With the right tools and strategy, you can turn more website visitors into loyal clients who recommend your firm to others.