Administrative tasks are the silent profit killers in accounting firms. While you’re focused on providing expert financial advice and preparing complex returns, mountains of paperwork, endless client follow-ups, and manual processes are eating away at your billable hours. Research shows the average accounting firm wastes 30% of a full-time employee’s time on avoidable administrative work.

That’s roughly 600 hours per year, per employee, spent on tasks that could be automated.

But here’s the reality:

The most successful CPA firms aren’t just good at accounting. They’ve mastered the art of operational efficiency. Not by working longer hours, but by implementing the right tools to eliminate administrative bottlenecks.

The best administrative tools help CPA firms:

- Automate repetitive client communications and follow-ups

- Streamline document collection and management

- Track deadlines and workflow progress automatically

- Eliminate manual data entry between systems

- Maintain compliance and audit trails effortlessly

These are the five tools I recommend for CPA firms that want to reclaim their time and focus on what actually generates revenue.

My Top 5 Administrative Tools for CPA Firms

- TaxDome: All-in-one practice management with automated workflows and client portals

- Financial Cents: Affordable workflow management focused on project tracking and deadlines

- Jetpack Workflow: Specialized workflow automation with accounting-specific templates

- ShareFile: Enterprise-grade document management with built-in security compliance

- Canopy: Modular practice management with strong tax resolution features

TaxDome

Best for comprehensive practice management that replaces multiple tools with one platform

Pricing: From $58 per month per user (annual billing); 14-day free trial available

TaxDome consistently ranks as the top choice for accounting firms that want to modernize their entire operation. It’s not just practice management software, it’s a complete business transformation platform.

I’ve seen firms replace 6-8 different tools with TaxDome alone, which explains why it has a 4.7/5 rating across thousands of reviews.

Automated Client Communication

Tax season communication is where most firms lose efficiency. TaxDome’s automated workflow system handles client follow-ups so you don’t have to.

You can set up automated sequences for different engagement types:

- Tax organizer reminders (with escalating urgency)

- Missing document requests with specific checklists

- Engagement letter follow-ups until signed

- Invoice payment reminders on customizable schedules

The system tracks every interaction and automatically moves clients through your workflow stages. When a client uploads their W-2, TaxDome automatically sends the next request for their 1099s.

This level of automation typically saves firms 10-15 hours per week during busy season.

Secure Client Portal with Mobile App

TaxDome’s client portal is where most firms see immediate client satisfaction improvements. Clients get a branded, professional interface where they can:

- Upload documents directly to the correct folder

- Sign engagement letters electronically

- Pay invoices with one click

- Track the status of their return in real-time

The mobile app means clients can snap photos of receipts or tax documents and upload them instantly. No more chasing clients for paperwork or managing email attachments.

The portal maintains complete audit trails, showing exactly when documents were uploaded, viewed, or signed.

Workflow Automation and Templates

TaxDome comes with pre-built workflow templates for common accounting processes:

- Individual tax return preparation

- Business tax filings

- Bookkeeping engagements

- Year-end financial statements

Each template includes task dependencies, automated client communications, and deadline tracking. You can customize these workflows or build entirely new ones using their drag-and-drop builder.

For example, their business tax workflow automatically triggers different document requests based on entity type and previous year’s filing status.

Pros & Cons

| Pros | Cons |

|---|---|

| Replaces multiple tools with one comprehensive platform | Higher per-user cost compared to single-purpose tools |

| Excellent client portal that clients actually use | Can be overwhelming for very small firms |

| Strong automation capabilities reduce manual work | Annual billing requirement for best pricing |

TaxDome Alternative: Karbon

Karbon offers similar practice management capabilities with a focus on team collaboration. It provides strong workflow management and client communication tools.

However, TaxDome offers better client portal functionality and more comprehensive automation features. For firms that prioritize client experience and administrative efficiency, TaxDome typically provides better value despite the higher cost.

Learn more: TaxDome

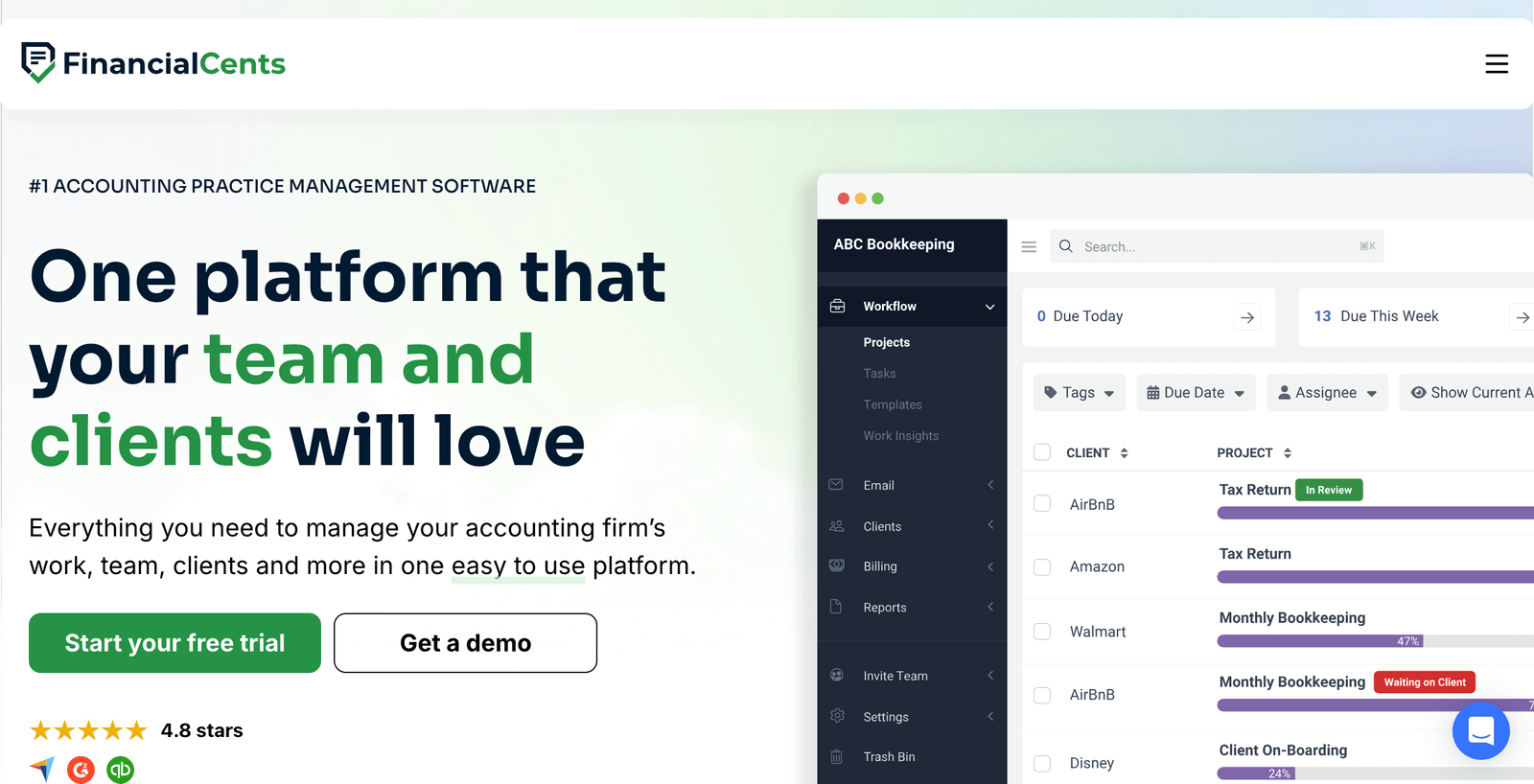

Financial Cents

Best for solo practitioners and small firms that need affordable workflow management without complexity

Pricing: From $19 per month (solo plan); $49-89 per month per user for teams; 14-day free trial

Financial Cents strikes the perfect balance between functionality and simplicity. It’s designed specifically for accounting professionals who want better project management without the learning curve of enterprise software.

The platform consistently receives praise for its intuitive interface and practical features that actually solve daily problems in accounting firms.

Project-Based Client Management

Financial Cents organizes all client work by projects, making it easy to track progress across multiple engagements. You can see at a glance:

- Which clients have work in progress

- Who’s assigned to each task

- What’s overdue or approaching deadlines

- How much time has been spent on each project

The dashboard gives you a bird’s-eye view of your entire firm’s capacity and workload distribution. This prevents overbooking during busy season and helps you identify bottlenecks before they become problems.

Automated Client Document Requests

The platform excels at automating the document collection process. You can set up automatic reminders that escalate until clients provide what you need.

For example, you might configure:

- Initial request for tax documents

- Gentle reminder after 3 days

- More urgent follow-up after a week

- Final notice before deadline

The system tracks everything and shows you exactly where each client stands in the process. No more wondering if you’ve followed up or manually tracking responses.

Time Tracking and Billing Integration

Financial Cents includes built-in time tracking that integrates seamlessly with billing. Team members can start timers directly from tasks, and the system automatically categorizes time by client and project type.

The billing features automatically generate invoices from tracked time, and you can send them directly through the platform. Integration with QuickBooks Online means your accounting records stay synchronized without manual data entry.

Capacity Management

One of Financial Cents’ standout features is capacity planning. You can see each team member’s workload and redistribute tasks before anyone gets overwhelmed.

The system shows:

- Expected hours for each team member this week

- Available capacity for new work

- Project deadlines that might create bottlenecks

This visibility helps partners make informed decisions about taking on new clients or adjusting deadlines.

Pros & Cons

| Pros | Cons |

|---|---|

| Affordable pricing with transparent, simple plans | Limited advanced features compared to enterprise solutions |

| Intuitive interface that requires minimal training | Some integrations still in development |

| Strong focus on practical accounting firm workflows | No billing module for Canadian users yet |

Financial Cents Alternative: Asana

Asana provides general project management capabilities and can be adapted for accounting workflows. It offers powerful task management and team collaboration features.

However, Financial Cents is purpose-built for accounting firms with specific features for client communication, document requests, and compliance tracking. For accounting professionals, Financial Cents typically provides better value and requires less customization.

Learn more: Financial Cents

Jetpack Workflow

Best for firms focused primarily on workflow automation and deadline management

Pricing: $30 per month per user (annual billing) or $45 per month (monthly billing); 14-day free trial

Jetpack Workflow is the specialist in the workflow automation space. While it doesn’t try to be everything to everyone, it excels at the specific problem of workflow standardization and task tracking for accounting firms.

Over 16,000 accounting professionals use Jetpack Workflow to ensure nothing falls through the cracks during busy periods.

70+ Pre-Built Workflow Templates

Jetpack Workflow comes loaded with templates designed specifically for accounting processes:

- Individual tax return preparation

- Corporate tax filings

- Monthly bookkeeping cycles

- Year-end procedures

- Client onboarding sequences

Each template includes task dependencies, estimated time requirements, and built-in quality control checkpoints. You can use them as-is or customize them to match your firm’s specific procedures.

The templates ensure consistency across your team. Every tax return follows the same process, regardless of who’s preparing it.

Automatic Recurring Workflows

For ongoing clients, Jetpack Workflow automatically creates new workflow instances on schedule. Your monthly bookkeeping clients get fresh workflows created automatically each month, complete with due dates and assigned team members.

This automation eliminates the administrative overhead of manually creating repetitive projects. The system handles the scheduling, and your team just focuses on completing the work.

Capacity Planning and Resource Management

Jetpack Workflow provides real-time visibility into team capacity. You can see:

- Budgeted hours per team member for the current week

- Actual hours worked versus planned

- Upcoming deadlines that might create conflicts

- Workload distribution across the team

This data helps you make informed decisions about staffing and client acceptance. During tax season, you can see exactly how much additional capacity you have before needing to extend deadlines or bring in temporary help.

Quality Control and Compliance

Every workflow includes built-in review and approval steps. You can configure multi-level reviews for complex engagements or simple partner sign-offs for routine work.

The system maintains complete audit trails showing:

- Who completed each task and when

- What review procedures were followed

- Any comments or exceptions noted during the process

This documentation is invaluable for quality control and helps maintain consistent standards across your team.

Pros & Cons

| Pros | Cons |

|---|---|

| Excellent pre-built templates for accounting workflows | Limited client communication features |

| Strong capacity planning and resource management | No built-in document management or client portal |

| Simple pricing with all features included | Fewer integrations compared to larger platforms |

Jetpack Workflow Alternative: Monday.com

Monday.com provides general workflow management capabilities that can be adapted for accounting firms. It offers flexible project tracking and team collaboration features.

However, Jetpack Workflow’s accounting-specific templates and compliance features make it more suitable for CPA firms. The pre-built workflows save significant setup time and ensure industry best practices are followed.

Learn more: Jetpack Workflow

ShareFile

Best for firms that handle sensitive documents and need enterprise-level security compliance

Pricing: From $55 per month for up to 5 users; custom pricing for larger firms; 30-day free trial

ShareFile specializes in secure document management and workflow automation for professional services firms. It’s particularly strong for CPA firms that work with highly sensitive financial data or need to maintain strict compliance standards.

The platform is SOC 2 Type II certified and supports FINRA/SEC compliance requirements, making it a trusted choice for firms that handle investment advisory work.

Document-Centric Workflow Automation

ShareFile’s workflows are built around document collection and management. You can create automated sequences that:

- Request specific documents from clients

- Send reminders until documents are received

- Route completed work for review and approval

- Automatically organize files in the correct folders

For tax preparation, ShareFile offers ready-to-use workflows that guide clients through the document submission process. The system knows which forms are required based on filing status and automatically requests missing items.

Client Portal with Advanced Security

ShareFile’s client portal provides bank-level security for document sharing. Clients can:

- Upload sensitive financial documents securely

- Access completed returns and correspondence

- Sign documents electronically with knowledge-based authentication

- Set document expiration dates and access controls

The portal maintains detailed audit logs showing exactly who accessed what documents and when. This level of security and accountability is essential for firms handling high-net-worth clients or complex business entities.

Integration with Microsoft Office and Outlook

ShareFile integrates seamlessly with the Microsoft Office suite that most accounting firms already use. You can:

- Send secure file links directly from Outlook

- Open and edit documents stored in ShareFile using Office applications

- Sync ShareFile folders to your desktop for native file access

This integration means your team can work with familiar tools while maintaining the security and audit trails that ShareFile provides.

E-Signature and Document Assembly

ShareFile includes built-in e-signature capabilities with knowledge-based authentication. This is particularly valuable for engagement letters, tax organizers, and other documents that require client signatures.

The document assembly features allow you to create templates for common forms and automatically populate them with client data. This reduces manual data entry and ensures consistency across documents.

Pros & Cons

| Pros | Cons |

|---|---|

| Enterprise-grade security with compliance certifications | Higher cost per user compared to basic document storage |

| Excellent integration with Microsoft Office suite | Limited project management features |

| Strong e-signature and document assembly capabilities | Can be complex for firms with simple document needs |

ShareFile Alternative: SmartVault

SmartVault offers document management specifically designed for accounting firms, with features for organizing tax documents and client files.

However, ShareFile provides stronger security features, better workflow automation, and more comprehensive integration options. For firms that need enterprise-level document management, ShareFile typically offers better value despite the higher cost.

Learn more: ShareFile

Canopy

Best for tax-focused firms that need strong IRS integration and tax resolution capabilities

Pricing: Modular pricing starting at $35 per month per user for workflow; additional modules for document management ($40/month) and time & billing ($25/month)

Canopy takes a modular approach to practice management, allowing firms to pay only for the features they need. It’s particularly strong for tax preparation and resolution firms that need deep integration with IRS systems.

The platform has built a reputation for understanding the specific workflows and compliance requirements of tax professionals.

IRS Integration and Tax Transcript Access

Canopy provides direct integration with IRS systems, allowing you to:

- Download client tax transcripts automatically

- Access account transcripts and wage information

- Pull client data directly from IRS records

- Track the status of filed returns

This integration eliminates manual data entry and ensures accuracy when preparing returns or responding to IRS notices. The system maintains audit trails for all IRS interactions, which is essential for compliance and client protection.

Specialized Tax Resolution Workflows

Canopy started as a tax resolution platform, so it includes sophisticated workflows for handling IRS collections and disputes:

- Offer in Compromise procedures

- Installment agreement negotiations

- Penalty abatement requests

- Audit representation workflows

Each workflow includes built-in compliance checkpoints and automated deadline tracking. The system knows IRS timelines and procedural requirements, reducing the risk of missed deadlines or procedural errors.

Document Management with E-Signatures

Canopy’s document management system is designed specifically for tax documents. It automatically organizes files by tax year and client, making it easy to find historical information.

The e-signature capabilities include templates for common tax forms and engagement letters. The system tracks signature status and sends automatic reminders for unsigned documents.

Client Request Automation

One of Canopy’s standout features is automated client requests. You can set up the system to automatically remind clients about:

- Missing tax documents

- Unsigned engagement letters

- Outstanding invoices

- Upcoming deadlines

The automation continues until the client responds, freeing your staff from manual follow-up tasks. The system tracks all communications and provides complete visibility into client responsiveness.

Pros & Cons

| Pros | Cons |

|---|---|

| Strong IRS integration and tax-specific features | Modular pricing can add up quickly |

| Excellent tax resolution workflow capabilities | Learning curve for complex features |

| Automated client communication and follow-up | Less suitable for non-tax accounting work |

Canopy Alternative: Drake Tax Software

Drake Tax provides tax preparation software with basic practice management features, including client organizers and e-filing capabilities.

However, Canopy offers much more comprehensive workflow automation, document management, and client communication features. For firms that want to modernize their entire practice, not just their tax preparation software, Canopy provides significantly more value.

Learn more: Canopy

Other Tools We Use in Our Administrative Workflow

Managing a modern CPA firm efficiently requires integration between multiple systems.

At the most successful firms I work with, these administrative tools connect with other essential software:

- QuickBooks Online Accountant for client accounting work and practice management integration

- Microsoft 365 for email, document editing, and calendar management

- Zoom or Microsoft Teams for secure client video conferences

- DocuSign for specialized e-signature needs beyond basic engagement letters

- Zapier for connecting different tools and automating data transfer between systems

Wrapping up

The right administrative tools don’t just save time, they transform how your firm operates and grows.

Choose based on your firm’s specific needs and current challenges:

- Choose TaxDome if you want comprehensive practice management that replaces multiple tools and provides the best client experience

- Choose Financial Cents if you’re a smaller firm looking for affordable, practical workflow management without complexity

- Choose Jetpack Workflow if your primary need is workflow standardization and deadline management

- Choose ShareFile if you handle highly sensitive documents and need enterprise-level security and compliance

- Choose Canopy if you’re a tax-focused firm that needs strong IRS integration and specialized tax workflows

The most successful firms start with one tool and gradually build their technology stack. Focus on solving your biggest pain point first, whether that’s client communication, deadline management, or document organization.

The goal isn’t to automate everything immediately. It’s to eliminate the administrative tasks that prevent you from focusing on high-value client work and business growth.